Ins and outs of the US Federal Debt in less than ten minutes

Just over a month ago, I gave a Pecha-Kucha presentation at church titled “How to get a 14 trillion dollar line of credit, what the hell is a lockbox, and are we going broke? The ins and outs of the Federal Debt and Deficit”. This was inspired by, and was an updated version of my Borrowed Friday Night blog entry.

So, without further adieu: A review on my petcha-kucha’d view on the US Federal Debt a doo.

So the amount of money the US Government is huge. I they borrowed it in pennies, it would be over 37 BILLION tons of pennies. That is if all those pennies were made after 1982, because the pennies made before then are 0.4 grams heavier than the ones made after that time.

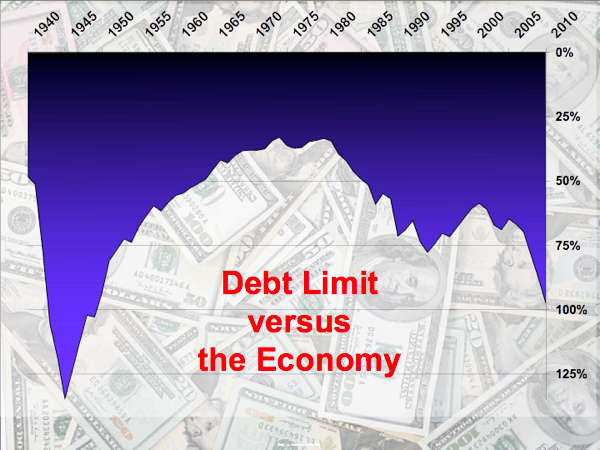

But what may surprise you is that the Federal Government has a Debt Limit. This basically is a function of the balance of the branches of government. Before modern times Congress would authorize the Executive branch to issue a specific amount of bonds for a specific purpose.

This eventually became cumbersome, so Congress passed a law saying that the Executive branch could borrow up to $X million dollars for whatever reason.

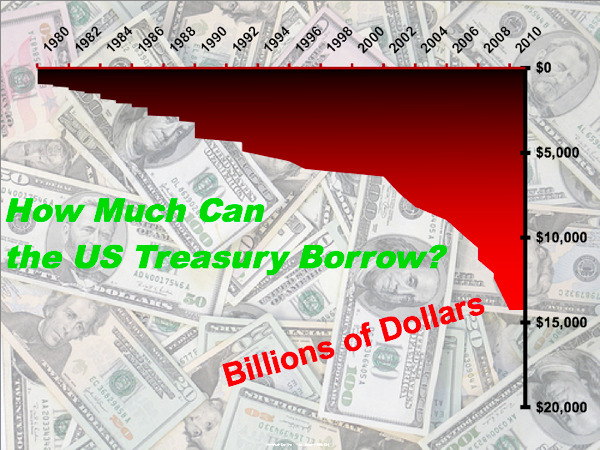

The debt limit is adjusted periodically, and generally the debt limit is only raised. In the data I’ve reviewed its been lowered a few times, but I surmise that is simply a function of a law expiring, because shortly thereafter the limit is raised again.

Through much of the country’s history the debt limit remained reasonably stable, but in the past thirty years, the debt limit has increased incredibly.

But a dollar today won’t buy the same amount as a dollar ten years ago (or even a year ago!) So it makes more sense to compare the debt limit versus the Gross Domestic Product, a measure of the annual economic output of the country. By this measure it was high right after World War II, but got much smaller and reached its smallest point in the 1970s, then went on a growth spirt.

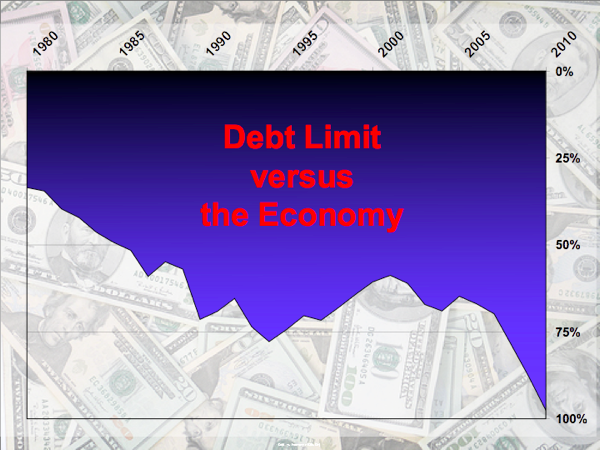

Again, if we look at this in the past 30 years, the debt limit has gone from about 30% of GDP to almost 100% of GDP. The only time this happened previously was a direct result of World War II.

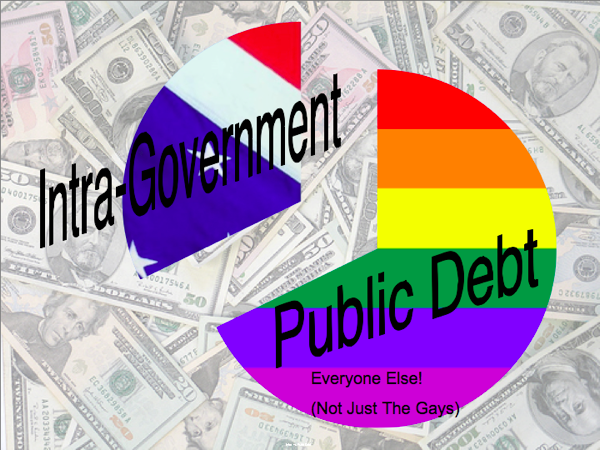

So where do we borrow all this money? The government loans itself about a third of it. I can hear you now, “Wait the government loans itself money?!?” Yup, up until about a year ago the Social Security Administration took in more money in taxes than they paid out in benefits.

Whatever they didn’t send out as benefits, was put into a lockbox. Yup, as a result of Congress’s schanagians, the bonds go into an actual lockbox. But why not invest it in stocks? Well, if the government did that we’d have government owning a large amount of the American economy, and that’d be socialism, which is, ummmm… bad.

So who loans the government money? The first source, is the American Public. The government sells bonds, a form of debt, to individuals, banks, insurance companies, and anyone else who wants to buy them.

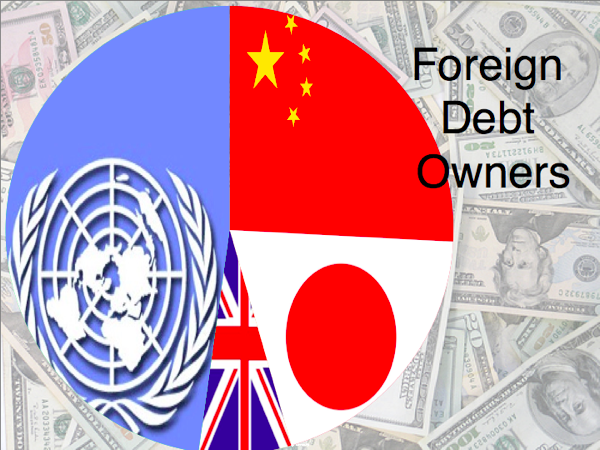

But the American public simply doesn’t have enough to loan the Federal Government. So about half of the money the federal government borrows is from overseas. About a quarter of the foreign debt is held by China, the next third is held by Japan, a sliver is held by the United Kingdom, and the remainder is held by a mix of countries. No I’m pretty sure the United Nations doesn’t hold any US Federal Debt.

So its not cheap to borrow $14.26 trillion dollars. The Federal government spends about $400 Billion a year on interest, or about 7.4% of the Federal budget. About half of this interest goes to those foreign debt holders.

So the question that should be asked is this level of borrowing sustainable? I honestly don’t think so. There are concerns about other country’s willingness to continue to lend money to us, but there is also the simple fact that we spend a significant amount of our annual budget simply to pay interest on that debt.

So how does this relate into class warfare?

This is simple to explain. Let us pretend that everyone for a moment is taxed at exactly the same rate, say 10%. If Jane makes $30,000 she’ll pay $3,000 of her income in taxes. If Joe makes $300,000 he’ll pay $30,000 of his income in taxes. But, Joe also decides to loan the government $30,000 of his income to the Federal government so he’ll get interest back, which will lower his effective taxes to say $25,000 or 8.3% of that back in interest. Jane on the other hand can’t loan even $1, let alone $3,000 or $30,000 to the Federal government, because she has to feed herself and her family. She will continue to pay 10% of her income in taxes, some of which goes to pay Joe.

Can someone please explain to me how this is fair?

To top it off, this also means that as we borrow more money, it gives some people ammunition to Starve the Beast, a.k.a reduce the size of the federal budget. While it is unclear where this will come from, recent history shows us that the most likely spot will come from the dismantling of the safety net. Also <tone type=”sarcasm”> known as folks that don’t matter, such as like young children without health care and the mentally ill.</tone>

Seriously though, this is where we’ve made cuts to the budget. Taking services that provide some shrivel of humanity to those who are barely able to get by as it is. That is immoral no matter what value system you personally hold.